Wonderland ($TIME) and $MIM scandal: what you need to know

Wonderland ($TIME) is one of the most popular projects in DeFi, so when it came out that its treasurer Sifu was actually a convicted felon operating under a fake name, a huge scandal broke out. $TIME and other projects by Wonderland’s founder Daniele Sesta took a huge hit. In this detailed article, we’ll untangle this complex story for you.

About Wonderland ($TIME)

Wonderland is a fork of the popular DeFi 2.0 project OlympusDAO, which we’ve covered in our article about DeFi 2.0. While OlympusDAO runs on Ethereum, Wonderland is powered by the Avalanche blockchain, which is much faster and cheaper to use.

Both projects aim to create a reserve currency for their respective networks, backed by a basket of assets: DAI, FRAX, ETH, and LUSD for Olympus and MIM, TIME-AVAX LP tokens, etc. for Wonderland. A reserve currency isn’t a stablecoin: its price shouldn’t go below $1, but it doesn’t have an upper limit. In fact, the price of TIME even reached $9,700 in November 2021, rising by 1200% in 2 months.

TIME is supposed to be better than regular stablecoins, because if the purchasing power of USD keeps going down, so will the real value of all dollar-pegged stablecoins. By contrast, an algorithmic reserve currency like TIME can keep its purchasing power.

However, it’s not the concept of a reserve currency that attracted so many people to Wonderland, but the sky-high staking APY: above 80,000%! However, in spite of high token inflation, the price of TIME shouldn’t drop too low, since it’s backed by the treasuy.

For example, in early February 2022 the total value of the treasury assets was $754 million, while the market cap was just $20 million. So, in theory, TIME’s supply could increase by quite a lot at that price, and it would still be overcollateralized.

When users stake TIME (after buying it on the Trader Joe DEX), they receive special MEMO (Memory) tokens, needed to unstake and withdraw TIME later. Basically as new TIME tokens are minted, most of them are distributed to the stakers, so that your staked MEMO balance will automatically increase every few hours: this is called rebasing. The rewards are auto-compounded with every rebase: that’s why the APY is so high.

Users can also mint TIME at a discount by supplying various assets to the treasury: TIME-AVAX and TIME-MIM LP tokens, wrapped AVAX, and some others. As the treasury grows, the protocol emits more TIME, and that’s how the rewards are financed.

Daniele Sesta and his other projects: Abracadabra ($MIM) and Popsicle Finance ($ICE)

@danielesesta, or Daniele Sestagalli, is a famous figure in DeFi. Apparently he’s Italian (though nobody knows for certain), and he’s extremely active on Twitter. Sesta’s first popular project was Zulu Republic (ZTX) - a platform where ‘people, businesses, and organizations’ could ‘thrive on their own terms’. By the end of 2018, the project had 140,000 users, but the project seems to have been discontinued since late 2020.

Apart from Wonderland, Daniele Sesta founded two very popular DeFi projects: Abracadabra Money ($MIM) and Popsicle Finance ($ICE). He’s also collaborating with another legendary developer, Andre Cronje (founder of yearn.finance) on a project called Solidly Swap.

Abracadabra Money is a stablecoin protocol that runs on five chains: Ethereum, Avalanche, Fantom, BSC, and Arbitrum One. Users deposit various assets as collateral to borrow MIM (Magic Internet Money) stablecoins. Next, they can deposit MIM in DeFi liquidity pools to farm rewards in Abracadabra’s SPELL tokens.

As of February 2022, MIM was the 6th largest stablecoin with a self-reported market cap of $2.85 billion. It’s quite a tumble from the $4.6 billion market cap before the Sifu scandal (don’t worry, we’re coming to it).

Finally, Popsicle Finance is a yield optimizer that allocates users’ assets (mostly WETH, or wrapped ether) across multiple pools to maximize the gains. With a TVL of just $22 million, it’s a relatively small DeFI protocol.

Why the ‘Frog Nation’?

Wonderland, Abracadabra, and Popsicle are interconnected and rely on each other’s success to grow: for example, Wonderland accumulates MIM in the treasury.

Together, these protocols and their loyal community are known as the Frog Nation. This grassroots movement operates under the slogan #OccupyDeFi. The name is a reference to Pepe the Frog memes that are extremely popular in crypto. For a long time, Daniele Sesta himself had a Twitter user pic with a green cartoonish version of himself resembling Pepe.

The scandal: how Sifu was found to be Michael Patryn

It all started on January 27, 2022, when Crypto Twitter’s best-known detective @zachxbt revealed Wonderland’s CFO Sifu to be Michael Patryn, co-founder of the defunct QuadrigaCX exchange. Now, there’s a lot to unpack in this sentence, so let’s take it step by step.

@zachxbt is very popular on Crypto Twitter for his tell-all threads that uncover various influencers’ dubious behavior and wrongdoings. These range from undisclosed paid ‘shills’ (token promotion) to downright scams. Zach uses a combination of on-chain analysis, message screenshots, and testimonials that sometimes go back several years.

This time, @zachxbt focused on Sifu (or 0xsifu), the pseudonymous CFO and treasury manager of Wonderland – and thus a close ally of Daniele Sesta himself. Zach made a worrying discovery: Sifu was none other than Michael Patryn, co-founder of QuadrigaCX.

QuadrigaCX was a relatively large Canadian crypto exchange, until its founder and CEO Gerald Cotton mysteriously disappeared in 2019. With him went the private keys to the crypto wallets holding $169 million of Quadriga’s clients’ money.

The official version was that Gerald Cotton died on a trip to India and his body was cremated. However, no one was ever able to verify it. Quadriga itself closed down.

Now let’s return to Gerald Cotton’s co-founder, Michael Patryn. As it turned out, before Quadriga he was known as Omar Dhanani, a convicted felon and scammer. In 2005-2007, Patryn/Dhanani had been prosecuted for identity theft, credit card fraud, burglary, and other crimes. He even did 18 months of prison time and was deported from the US to Canada.

Daniele Sesta’s reaction and the crash of $TIME

Did Daniele Sesta know that his CFO was a convicted criminal? As it turns out, he did: Zach confirmed this via DM (direct messages) with Sesta himself – who said that Patryn was ‘a good man’ but also the biggest risk to his reputation

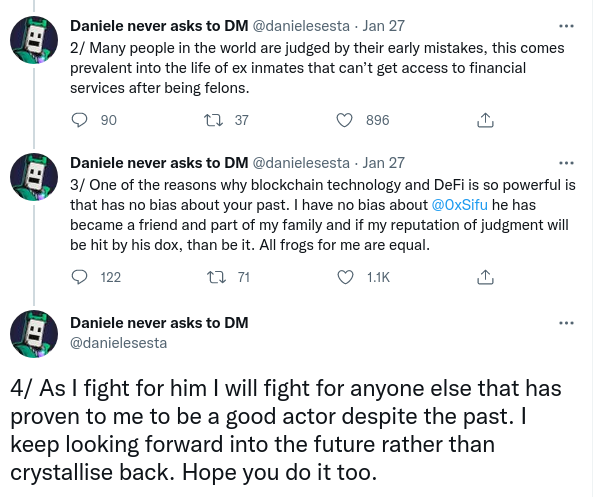

Sestagalli claims to have found out about Patryn/Dhanani a month before everybody else – but he chose to keep it a secret. On January 27, Daniele Sesta published a statement on Twitter, saying that he saw Patryn/Dhanani as ‘family’ and ‘a good actor’ – and that he shouldn’t be judged by his ‘early mistakes’.

It may be true that one’s past shouldn’t determine one’s future, but the crypto market and the Frog Nation weren’t impressed. The price of $TIME fell by 36%, $SPELL by 15%, and $ICE by 30%. Many even began to speculate that $MIM could lose its peg.

To be fair, all three projects already weren’t doing great by that point. $TIME, $SPELL, and $ICE had lost most of their recent gains during the market correction in December and January. But the worst part came on January 26, when $TIME was hit by a liquidation cascade, losing 40% in 24 hours.

The main reason was liquidations: $TIME stakers used their $MEMO (or, rather, wMEMO, or wrapped MEMO) rewards to borrow $MIM. Next they bought more $MEMO with that $MIM, and so on in a loop. They ended up with highly leveraged wMEMO positions - and when the price dropped, their MEMO was automatically sold to pay off the $MIM debts, creating more selling pressure and a further price drop.

Daniele Sesta himself was reportedly liquidated this way for $15 million; and Sifu for $1.6 million.

The DAO in action: the community votes to remove Sifu but continue Wonderland

Sifu’s fate is decided

Daniele Sesta couldn’t just fire Sifu. Wonderland is a DAO (decentralized autonomous organization), where TIME holders vote on all important decisions. It was up to them to decide if Sifu were to be removed as the treasury manager?

Between January 27 and 29, 64,000 TIME tokens participated, with one $TIME standing for one vote. The majority (88%) voted to remove Sifu – which was immediately done.

The DAO votes to keep Wonderland going

At that point, many felt that Wonderland’s and Sesta’s reputations were damaged beyond repair. What was to be done with the protocol and the funds in the treasury? A new vote was called, with two options:

1) Wind down Wonderland and give every MEMO holder their share of the treasury. The OlympusDAO fork experiment on Avalanche would be considered over.

2) Continue the experiment and appoint someone new to take care of the treasury and of the project in general.

There was a catch to the second option, though: if the community voted to keep Wonderland in operation, they would then have five days to submit a list of candidates willing to take on the leading role. If the TIME holders failed to come up with a list, Wonderland would be closed down.

Interestingly, Daniele Sesta himself was in favor of winding down Wonderland. As the vote was very close at some point, he tweeted that ‘the experiment’ was ‘coming to a close’ and that the team would reimburse those who didn’t want to stay. This was also the preferred option of some ‘whales’ or large TIME holders, who held a correspondingly large number of votes.

However, when the dust settled, 55% of the votes were in favor of keeping Wonderland operational. A total of 22,509 TIME addresses voted – more than on any other proposal in the protocol’s history. Together, smaller holders managed to win back the vote from the ‘whales’ – a win for the DAO concept, perhaps.

Sifu cashes out 3,000 ETH

Meanwhile, Sifu himself apparently started moving his ETH using Tornado Cash, a popular mixing service that makes it hard to trace where funds go. Starting from February 1, the address sifu.eth, associated with Sifu, cashed out 2,000 ETH (around $5.54 million), followed by 1,000 ETH more on February 2.

Some crypto media were quick to announce that Sifu ‘laundered’ those millions, since Tornado Cash is often used to launder stolen crypto. However, the man himself maintains that he had earned that money through trading and investing, and that none of it was ‘stolen’, suggesting that anyone who doubted him could track his wallet.

What’s next for Wonderland and TIME?

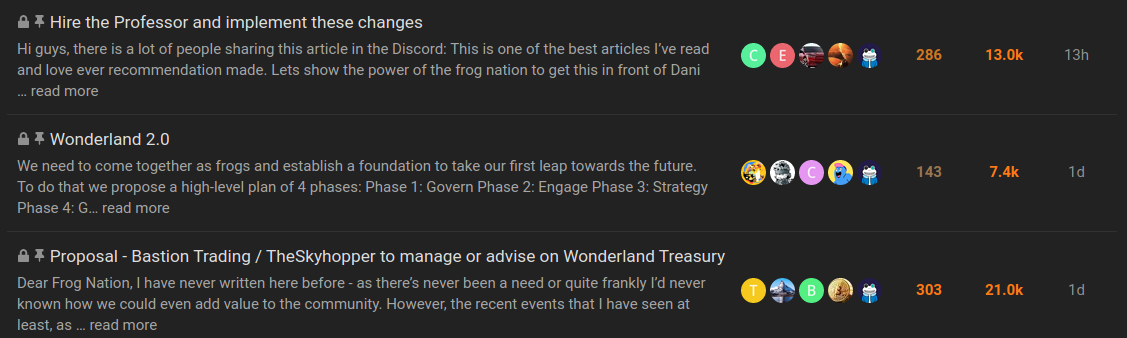

How exactly will Wonderland move forward after so much reputational damage – and who will take charge of the treasury? Daniele Sestagalli tweeted that he’d soon submit a ‘proposal’, but so far nothing is clear. The Wonderland governance forum features many conflicting ideas: for example, Bastion Trading’s TheSkyHopper has proposed himself as the new treasury manager, but there’s also a suggestion to hire a crypto analyst known as The Professor to advise on the project.

Moreover, the team running Abracadabra Money had expressed interest in merging with Wonderland, and this deal could still go through.

However, even if the Frog Nation manages to solve its administrative and financial issues, it may soon face trouble on another front. According to Brookwood P.C. managing partner Colin Belton, the SEC could pronounce $TIME a security because of the centralized, multi-sig based management of funds. The regulator might use Wonderland as a precedent in an attempt to finally start regulating DeFi.

A wonderland for fraudsters or a life-changing opportunity?

With its 80,000% APY, Wonderland generated enormous gains for a lot of users, and this could be seen as proof of the life-changing power of DeFi.

On the other hand, it turned out Wonderland’s treasury of $700+ million was run by a convicted criminal. For many this is a sign that DeFi is still a Wild West-like space that needs stricter regulations. A Bloomberg article even came out under the title ‘Crypto Secrecy Makes DeFi a Financial Felon’s Wonderland’.

The events around Wonderland show the risks of so-called DAOs that are in fact managed by a limited circle of individuals. A potential solution could be proper on-chain managed treasuries based on networks like Kusama and Polkadot. In other words, to make sure that funds are SAFU, protocols should keep them away from characters like Sifu.

We at Pontem Network are watching these events closely, since our own product bridges the free and open possibilities of DeFi on Kusama and the technology developed for the Diem blockchain. In fact, Pontem is an experimentation platform for Diem built on Substrate: it allows developers to test out their Diem-compatible apps in a live environment and gain traction and liquidity on Kusama and Polkadot.

Summary: how the Wonderland scandal unfolded

- Wonderland ($TIME) is a DeFI project created by Daniele Sestagalli; it runs on the Avalanche blockchains and offers users to earn 80,000% APY by staking $TIME. The price of TIME rose by 11x over just 2 months in 2021.

- On January 27, crypto Twitter ‘detective’ @zachxbt revealed that Wonderland’s treasury manager Sifu was none other than Michael Patryn, a convicted felon and former co-founder of the collapsed Canadian exchange QuadrigaCX. Patryn had been prosecuted for identity theft and burglary, among other things, and even served 18 months in prison.

- The price of TIME and the tokens of Daniele Sestagalli’s other projects, Abracadabra Money ($SPELL) and Popsicle Finance ($ICE), crashed following the news.

- The DAO of TIME holders voted to remove Sifu as treasury manager.

- Another vote established that Wonderland should continue operating – as opposed to winding down, as Daniele Sestagalli would have preferred.

- As of early February, there is no clear roadmap for how Wonderland should move forward; Sestagalli is expected to submit a proposal in the coming weeks.

The Wonderland drama isn’t over, and its eventual outcome can impact DeFi on different blockchains. As always, Pontem Network will bring you the detailed analysis – follow us on Twitter and Telegram and be the first to learn the latest scoops.

.svg)

.png)

.png)