A DEEP DIVE INTO THE VENUS PROTOCOL

Venus is the first algorithmic-based money-market platform on the BNB chain that facilitates the borrowing, lending, and minting of crypto assets. In this article, we’ll discuss Venus, and explain how it creates an equitable and secure environment for lending and borrowing crypto assets.

TL; DR

- The Venus Protocol was developed to offer users access to a decentralized, secure marketplace where they could seamlessly get crypto loans, earn interest, or mint synthetic stablecoins.

- Users must provide collateral that will be locked in accordance with the protocol in order to borrow any of the supported cryptocurrencies, stablecoins, or digital assets from Venus.

- Users that offer their digital assets on the Venus protocol receive a vToken, which is the sole token that can be used to redeem the stated underlying collateral.

- By using the vTokens from the underlying collateral that they had previously provided to the protocol, users would be able to mint VAI, a synthetic stablecoin tied to the USD.

- The Venus native token, XVS is a utility token that governs the Venus protocol. Holders of the XVS token are entitled to governance rights as they can make and vote on proposals that determine the future of the protocol.

WHAT IS VENUS?

Venus is a decentralized fiance (DeFi) protocol built atop the BNB blockchain that enables users to borrow, lend, and earn cryptocurrencies in addition to minting synthetic stablecoins.

Venus issues synthetic stablecoins with over-collateralized positions that safeguard the protocol, in addition to allowing users to use the collateral they provide to borrow additional assets. As an algorithmic money market for BEP-20 assets, Venus was built exclusively for the BNB chain. Hence, it facilitates lower transaction costs as compared to other DeFi protocols that provide the same functionality such as Compound and MakerDAO.

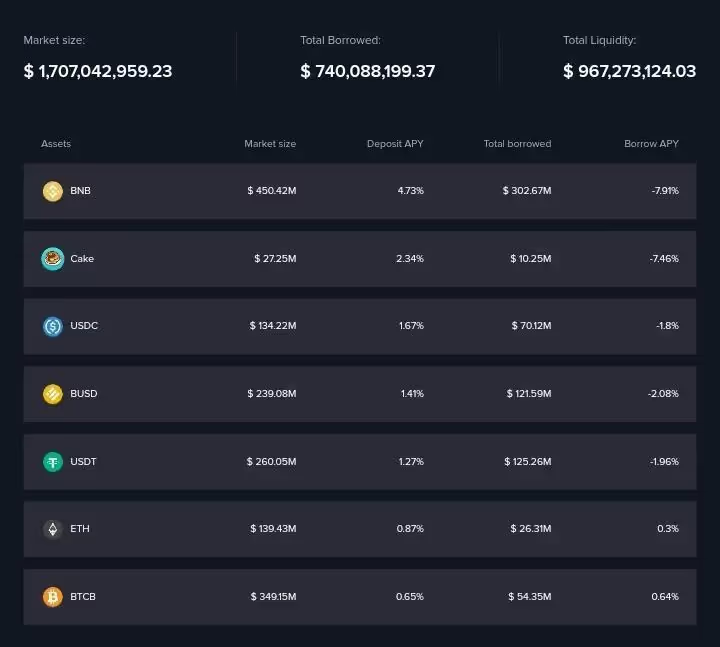

The Venus protocol has enormous potential since it has a market cap of $1.707 billion and $967.273 million in total liquidity, having borrowed more than $740.088 in assets as of the time of writing.

Thanks to its support for nearly instantaneous transactions, the Venus protocol is the first universal money market to give users access to loan markets for Bitcoin (BTC), Ripple (XRP), Litecoin (LTC), and other well-known cryptocurrencies.

OVERVIEW AND HISTORY OF VENUS

Venus was developed by the Swipe project team led by Joselito Lizarondo in 2020. Due to some crisis, the Swipe core team and Joselito left the venue protocol, and In 2021, the project came under new leadership headed by Brad Harrison.

Brad earned his undergraduate degree from Harvard University and he holds a Ph.D. in Neuroscience from the University of Cambridge. Brad has more than ten years of expertise in product management with a wealth of experience working with leading corporations such as Chairlift Inc, Bank of America, IGNITER, ORM, and Jur.

The Venus Protocol testnet went live in October 2020, and at the end of November of the same year, its venus mainnet officially went live, granting users access to six cryptocurrencies; SXP, USDT, BUSD, XVS, USDC, and BNB. Since then, Venus has listed additional assets and has significantly expanded its product line.

In January 2021 Venus moved its admin keys to its time lock smart contract, thereby transferring the administration of the protocol to the community, giving holders of its native token the right to create proposals that determine the future of the protocol.

In May 2021, Venus suffered a large liquidation incident due to market conditions and oracle issues, resulting in a loss of about $77M. In an official statement made to its community members, it was revealed that Joselito had been dealing with a health crisis, which was why the protocol was poorly supervised and mismanaged. Thus, the Swipe core team and Joselito were relieved of their duties from Venus to focus on Swipe.

After the departure of Joselito and the swipe core team, Venus launched its snapshot governance mechanism in February 2022 and announced the Venus Logo and brand refresh competitions to source for new logo and brand design ideas from its community. The winners of the competition were decided based on the votes cast by community members.

In March 2022, the Venus community implemented the results of the community votes and launched the new logo and color scheme which was followed by a revamped user interface. In the same month, Venus launched the UST and LUNA Markets, introduced the Venus rewards token (VRT) vault, and enabled the VRT swap functionality that allows users to swap VRT for XVS.

In May 2022, the Mini-Program of the Venus Protocol went live on the Binance Mobile App. However, before that, Venus was affected by the collapse in LUNA token prices which was caused by an abrupt suspension of Chainlink's LUNA price feed due to extreme market conditions leading to a loss of over $11.2 million

Venus, which was the second largest platform on the Binance chain at the time of this incident, lost about 28% of its TVL – which was around one billion dollars according to DeFiLlama – in under 24 hours. However, Venus is bouncing back to its feet as it currently has a total value locked of about $919.91 million in addition to over $770.91 million worth of borrowed assets.

HOW DOES VENUS WORK?

Venus, a fork of Compound and MakerDAO, combines a money market protocol with the ability to mint synthetic stablecoins, allowing users to utilize the same collateral for both activities inside the same ecosystem. The network is user-friendly and is built to determine how much of a loan a user is eligible to take depending on their collateral.

Users must provide collateral that will be locked in accordance with the protocol in order to borrow any of the supported cryptocurrencies, stablecoins, or digital assets from Venus. Users that offer their digital assets on the Venus protocol receive a vToken, which is the sole token that can be used to redeem the stated underlying collateral.

By using the vTokens from the underlying collateral that they had previously provided to the protocol, users would be able to mint VAI, a synthetic stablecoin tied to the USD.

ABOUT THE VENUS TOKENS

The XVS token and VAI stablecoins are very crucial to the operation of the Venus protocol.

Holders of the XVS token can vote, and participate in governance since they can suggest new collaterals and protocol modifications. As of the time of writing, XVS had a market capitalization of over 65.841 million US dollars and was trading at $5.10, representing a drop of roughly 96.12% from its all-time high in May 2021 when it traded for $139.32.

VAI stablecoins are minted using XVS. In order to earn income by taking part in the Venus liquidity mining program, VAI may also be minted using the vTokens from previously provided collateral and deposited into the Venus Vault. As of the time of writing, VAI had a market capitalization of over 56.137 million US dollars and was trading at $0.9636, representing a drop of roughly 28.91% from its all-time high in January 2021 when it traded for $1.3623.

The Venus Reward Token (VRT) is a technique designed to serve as an extra mining distribution to Venus Protocol lenders and liquidity providers. The objective is to gradually reduce the inflation rate of XVS while also including XVS burning in the process. As of the time of writing, VRT had a market capitalization of over $7.376 million US dollars and was trading at $0.0003356, representing a drop of roughly 96.62% from its all-time high in May 2021 when it traded for $0.009847.

FINAL THOUGHTS

Thanks to the BNB Chain, Venus introduces a novel paradigm for decentralized finance (DeFi) and is striving to become a fully-fledged interoperable multichain protocol. Next-gen layer-one chains such as Aptos possess the capability to power revolutionary protocols such as Venus as it currently outperforms most contemporary layer-one blockchains in terms of speed, cost, security, and scalability. In addition to incurring near-zero fees and the ability to handle up to 160,000 transactions in one second with sub-second finality.

Aptos, is home to over 30 DeFi projects, including lending protocols such as Argo, Aptin Finance, Mobius, Vial, and Abel Finance,

Pontem, a leading product studio that facilitates global financial inclusion is the gateway to the Aptos blockchain and is developing the infrastructure and decentralized tools necessary for the adoption of the Aptos blockchain. The Pontem wallet enables its users to connect to decentralized applications, explore the Aptos ecosystem, and exchange tokens. Moreover, Pontem's Liquidswap which is the first Automated Market Maker (AMM) on Aptos makes it seamless for users to swap tokens in a safe and decentralized manner, in addition to offering liquidity pools and a bridge that facilitates asset transfers across blockchains.

ABOUT PONTEM

Pontem is a product development platform that fosters global financial inclusion through blockchain technology. As a result of its partnership with Aptos, Pontem can create the foundational dApps, EVMs, AMMs, and other infrastructure needed to adopt its layer one blockchain.

.svg)