DeFi on Aptos: 20+ dApps you should know

With Aptos DeFi TVL reaching a new $60 million high, it’s time for a massive update of our Aptos DeFi dApps guide!. We’ll look at DEX exchanges like Liquidswap, stablecoins, lending protocols, CLOBs, liquid staking, and more.

Note: We’ve only included those dApps that are live on the Aptos mainnet. A lot of exciting activity is happening on the testnet, too, and we’ll add those dApps to the list once they go live on mainnet.

TL;DR

- The Aptos ecosystem already includes 200+ projects, including dozens of DeFi dApps.

- The most popular DEX and AMM dApps on Aptos are Liquidswap by Pontem Network, Hippo, Cetus, and Enchanted Finance. Liquidswap already has 160k unique users! We also shouldn’t forget CLOBs like Econia and Laminar.

- There are several lending protocols on Aptos: Argo, Aptin Finance, Mobius, Vial, and Abel Finance, among others.

- For liquid staking on Aptos, there’s Tortuga Finance and Ditto. Other teams working on liquid staking include Stader and Stratios. If you’re looking for more complex DeFi strategies, check out SEAM, whose bundle vaults feature pools on Liquidswap, and prediction markets with Mojito Markets.

- These dApps support one or several of the wallets for Aptos: Pontem Wallet, Martian, Petra, Fewcha, and Spika.

- When connecting a wallet, you should make sure to set it to the right network: testnet, devnet, or mainnet. The projects on this list are all live on mainnet.

- The best resources to keep track of new DeFi projects on Aptos are Pontem Network and MoveMarketCap. The ecosystem is developing very fast, so check back often!

Aptos ecosystem: 200+ dApps in 3 months

Few L1 blockchains have attracted as much interest as Aptos. Less than three months after the mainnet launch, Aptos already has over 200 projects in its ecosystem. The DeFi total value locked (TVL) has reached $60 million, placing it ahead of well-known chains like Ronin, Metis, and Moonriver. Aptos wallets like Pontem Wallet have hundreds of thousands of installs.

DeFi on Aptos covers the whole range:DEX exchanges,lending protocols, stablecoins, liquid staking solutions, liquidity aggregators, margin trading platforms, and even complex ETF-like products.

The ecosystem is evolving very rapidly, so we will keep updating this post. For now, here are the most powerful and interesting dApps on Aptos, including several native dApp integrations in Pontem Wallet. You’ll find even more on Pontem Network’s Ecosystem page and on MoveMarketCap -- both great resources to explore dApps on Aptos.

DEX and AMM on Aptos

Liquidswap

Liquidswap by Pontem Network was the first decentralized exchange (DEX) to launch on Aptos. It supports 25+ verified assets, including APT, USDT and USDC (both in the LayerZero, Wormhole, and Celer bridged versions), DAI, WETH, WBTC, BNB, BUSD, CAKE, stAPT and tAPT (liquid staking tokens), SOL, ABEL, etc.

It also includes an integrated Liquidswap Bridge by LayerZero, allowing you to bridge crypto between Aptos, Ethereum, BNB Chain, Polygon, Avalanche, Arbitrum, and Optimism.

Audited projects can get their tokens listed on Liquidswap by filling out the submission form. Of course, you can also swap unverified tokens, as long as you know a token’s contract address and there is a pool with enough liquidity.

Liquidswap has been audited by three major security companies specializing in Move: OtterSec, Halborn, and Zellic. It’s the only triple-audited Aptos DEX on the market.

You can connect to Liquidswap with Pontem Wallet, Petra, Martian, Rise, Fewcha, Msafe, and Blocto.

One of the most interesting things about Liquidswap is that it features two types of pools:

- Regular pools for uncorrelated assets, such as APT-USDT and BTC-USDT. These pools use the same liquidity curve formula as Uniswap.

- Stable pools for assets with correlated prices,. like USDT-USDC. These use an advanced curve formula pioneered by Curve and Solidly to minimize slippage.

As of mid-January 2023, Liquidswap has over 100k unique users and regularly hits the $1M daily volume mark. You can deposit liquidity into pools to earn up to 43% APR from trading fees.Check the Stats page to see which pools are generating most returns.

Very soon, Liquidswap will introduce yield farming under the name Hydroponic Farms -- and you’ll even be able to get a reward boost if you hold a Pontem Space Pirate NFT. Stay tuned!

PancakeSwap

The biggest DEX on BNB Chain, PancakeSwap took the Aptos ecosystem by storm offering Pancake’s famous yield farms. It was the first to launch liquidity mining on Aptos, and this propelled the DEX to the no.1 spot on the Aptos TVL list. It will be interesting to watch how things unfold once Liquidswap launches its own yield farming platform, Hydroponic Farms.

There are over 10 live Aptos farms on PancakeSwap, with APR ranging from 10% to 77% (as of January 2023). The rewards are paid in CAKE, which is deployed natively on Aptos.

Apart from farms, there are two single-token staking pools (Syrup Pools). You can stake CAKE to earn 47% APR in Ditto Finance’s stAPT or ceUSDC (Celer USDC).

PancakeSwap regularly burns CAKE to keep inflation at bay. In the past 6 months, the DEX burned $585 million worth of its native token.

Of course, you can also swap Aptos tokens on PancakeSwap, though it doesn’t maintain as long a list of verified and audited coins as Liquidswap.

AUX

Apart from regular swaps, AUX supports market and limit orders with a decentralized central limit order book (CLOB). You can set the desired price and quantity and place an order, which will be filled when the price hits target. There are even advanced order types like “Immediate or Cancel” and “Fill or Kill”.

All this, together with candle charts, give you a trading experience similar to a CEX. There are still less than 10 supported currency pairs, and the order book is very thin, but CLOBs are definitely a niche to watch.

As for DEX swaps, AUX offers lower trading fees than other AMMs: 0.10% for the most popular pools and even 0.00% for USDT/USDC. There’s also a handy portfolio viewer.

Check out our detailed AUX exchange tutorial.

Other Aptos DEX platforms to try

AnimeSwap

This is the place to go for memecoins on Aptos, as well as the project’s own ANI token. There is also a very convenient list of all the pools with their current reserves, so that you can see which ones are more liquid.

HoustonSwap

This DEX offers concentrated liquidity, similar to Uniswap v3. Liquidity providers can set price ranges in which their funds should be deployed, so that they keep earning fees instead of the liquidity sitting idly in the pools.

Obric

This self-professed ‘poor-friendly’ DEX had a TVL of around $220k in mid-January 2023, with $350k in daily trading volume. The peak daily volume was almost $9 million, registered on January 10.

Obric offers both uncorrelated and stable swaps, just like Liquidswap. Tradable pairs include APT-USDC (Wormhole and LayerZero), USDC-USDT, and APT-tAPT.

Recently Obric reported a bug in the pricing of its APT-USDC pool, which resulted in an excessively high APR, though this shouldn’t have affected users significantly, as Obric owns most of its liquidity.

Aptoswap

Aptoswap is another Aptos DEX in the top 20 by TVL, though there are only a few liquid pools. Yield farming (liquidity mining) should be introduced soon.

Other trading projects on Aptos

The following projects aren’t exactly DEXes, though they do offer swaps.

Hippo

Hippo Labs has a liquidity aggregator: a tool which aggregates multiple exchanges on Aptos to find the best swap rates. For any currency pair, Hippo finds the best route (usually indirect) to maximize the amount you get after fees.

Hippo’s aggregator is available as a separate product for other dApps to integrate, including Aries Markets, for example. The total volume of swaps made using the Hippo aggregation mechanism recently hit $100 million.

As with other DEX dApps on Aptos, you can adjust the slippage tolerance, transaction deadline (60 seconds by default), and max gas fee for each trade.

Kana Labs

Kana Labs is a cross-chain DeFi platform featuring a DEX aggregator, lending and borrowing, staking, and even a multichain wallet. On Aptos, it offers swaps, which can be routed via Liquidswap, AUX, PancakeSwap, Aptoswap, etc.

The Kana Labs dApp also allows you to access APT liquid staking in Ditto Finance and to buy APT with Visa/MasterCard, Venmo, CashApp, SEPA transfers, Apple Pay, GPay, and other systems (powered by Transac).

Another interesting feature is a referral program -- one of the first in the Aptos ecosystem. There is also a leaderboard of wallets, ranked by transaction volume.

Mole Finance

Mole is a leveraged yield farming protocol: the user’s own tokens are deposited as collateral to borrow funds and increase farming positions. This implies undercollateralized loans, where the loan value is higher than the collateral. Farming rewards are reinvested to achieve an even higher APY.

Leveraged yield farming is a risky tool that was popularized by Alpaca Finance and Alpha Homora, and Mole is the first to bring it to Aptos. You can choose between circa 10 PancakeSwap farms, such as USDC-APT and WETH-APT.

The leverage ratio is between 3x and 4.5x, meaning that you’ll earn around 3x or 4.5x the rewards that you would earn if you deposited funds directly into PancakeSwap. The APR varies from 21% and a whopping 280%. Mole also has savings pools with APRs below 1% and DEX trading funds.

At the time of writing, Mole ranked in the top 20 of Aptos DeFi dApps by TVL. Remember, however, that leveraged DeFi products always carry much higher risks, especially during periods of intense price volatility.

Lending & borrowing on Aptos

Aries Markets

Aries Markets is a margin trading protocol with built-in AMM swaps and lending pools.We placed it in the Lending section because, for now, loans constitute most of the activity in the dApp, with over $90k worth of crypto borrowed through Aries so far.

You can borrow tokens against the assets you already have to perform swaps or other DeFi operations. Note that you first need to open an account and deposit funds before taking on leverage.

For example, you can deposit USDC into an Aries account, take out a loan in APT, and use that APT for liquid staking or yield farming to earn extra rewards. Or you can perform leveraged swaps for borrowed assets in the Aries dApp.

As is typical in DeFi, the maximum loan value is less than the collateral value. Your collateral deposit will also earn you a small amount of interest, (up to 3% APR). The borrowing interest rate is currently around 4%, though the rates fluctuate constantly.

The upcoming margin trading protocol by Aries Markets will use a decentralized central limit order book (CLOB), similar to AUX. Users will be able to place both market orders (to buy or sell instantly at the best available price) and limit orders (to buy or sell at a specified price). You’ll be able to use borrowed funds to open bigger leveraged positions.

We’ve just added a native Aries integration to Pontem Wallet. Now you can open an Aries account, deposit funds, and borrow and repay crypto without leaving the wallet.

Argo

Argo protocol combines lending and a stablecoin, similar to MakerDAO. You can deposit collateral in APT or other tokens and mint USDA stablecoins. 1 USDA is equivalent to $1, and the whole USDA supply is backed by APT and other high-quality assets in the reserve. You can access Argo directly from the dApps directory in Pontem Wallet.

Argo has a sophisticated security system to prevent stablecoin exploits. For example, all collateral vaults are separated from each other, and there is a limit on how much the system’s debt can increase in an hour. The contracts have been audited by OtterSec.

Once you’ve connected a wallet, go to the Borrow section → Open Vault, and choose one of the vaults. At the time of writing, the vaults for liquid staking tokens by Ditto and Tortuga had a negative net borrowing APR, meaning that you are paid to borrow! The rest of the vaults have a 1% borrow APR.

When opening a vault, make sure to set the gas fee to Optimal in Pontem Wallet. Once you’ve deposited some collateral in the vault, go to the Mint tab to borrow USDA.

It’s safer to mint less than the upper limit. This way, you’ll keep the collateralization ratio high enough to protect you from liquidation if the oracle price of APT drops.

Remember that taking out a loan is just part of the process -- you also need to return it! If your vault has a positive net borrow APR, your debt will start to accrue interest immediately.

USDA was the first native stablecoin on Aptos, live on mainnet on Day 1. It isn’t used very widely yet: the most liquid pool is USDA/APT on Liquidswap with $1.4k in the pool. However, the possibility to earn a net yield when borrowing USDA with stAPT and tAPT is definitely interesting.

Aptin Finance

Aptin is a lending protocol whose dashboard design is very similar to Aave’s. You can lend or borrow APT, WETH (LayerZero or Wormhole), USDC (also LayerZero or Wormhole), and Tortuga’s tAPT. Lending APR varied from 0.05% (tAPT) to 0.88% (zWETH) in January 2023. zWETH also had more liquidity than any other supply asset: almost $200,000, out of the total market size of $350k.

If you want to borrow crypto, prepare to pay between 0.94% (zUSDC) and almost 5% (zWETH). As usual with DeFi lending, the rates fluctuate based on supply and demand, and you should always keep an eye on the liquidation threshold.

In the future, it will also be possible to stake Aptin’s own token, APN, to earn rewards in the Staking tab. APN hasn’t been launched yet, and the token generation event date hasn’t been announced.

Abel Finance

Abel Finance is a lending protocol on Aptos where you can lend and borrow 10+ assets: APT, USDC and USDT (bridged with LayerZero, Wormhole, and Celer), SOL, ETH, BTC, liquid staking tokens tAPT and stAPT, and the platform’s own ABEL token. In January 2023, the total supply was approaching $500,000, with almost $200,000 borrowed.

Between January 15 and January 22, 2023, Abel Finance ran an early bird ABEL farming campaign. It is reflected in the very high APYs in the screenshot above. In the future, ABEL stakers will also be able to earn rewards.

Liquid staking on Aptos: Tortuga Finance and Ditto Finance

Liquid staking in DeFi means staking a blockchain’s native coins, and in return, receiving special derivative tokens that can be used to earn extra DeFi yields. Regular Proof of Stake staking carries high opportunity costs, as the coins you lock up could earn you more through lending, yield farming, and other options. With liquid staking, you can have the best of both worlds, simultaneously collecting PoS staking rewards and the yields paid by other protocols.

Liquid staking is popular on Ethereum, Solana, Polkadot, Polygon, and now on Aptos, too. Check out our guide to liquid staking for more background info.

Ditto Finance

With Ditto, you can stake APT to receive stAPT and earn 7% APY, plus any additional rewards that you’ll earn with stAPT staking, farming, etc. Pontem Wallet now has a native integration with Ditto, so you can stake APT directly in the wallet interface.

stAPT has virtually the same value as APT in January. But as staking rewards slowly compound, it should become more valuable.

stAPT is already supported by most Aptos DEXes and lending protocols. In the future, it should be integrated into yield farms, NFT marketplaces, and other Aptos dApps. For now, Ditto is running its own liquidity mining program with up to 30% APR.

You’ll need to deposit stAPT and either USDC or APT in a liquidity pool on Liquidswap, then stake the resulting LP tokens on stake.dittofinance.io. You can also stake stAPT directly in a single-token pool.

The rewards accrue in DTO, or Ditto Discount Tokens, which will allow you to buy the real Ditto tokens with a discount at launch. There is no Ditto token for now.

On January 13, 2023, Aptos Insights reported that both Ditto and Tortuga were the fastest-growing projects on Aptos, with a 31% and 25% 24-hour increase in TVL respectively. Clearly, interest in liquid staking on Aptos is very high.

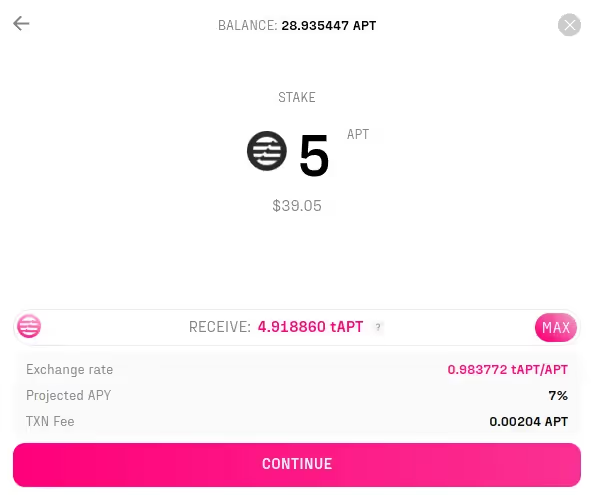

Tortuga Finance

Tortuga Finance was the first to launch a liquid staking dApp on Aptos testnet. You can stake APT (which will be distributed among the most reliable validators) to get liquid tAPT. The default APY is 7%.

Note that you can receive a bit less than 1 tAPT for 1 APT, as the price of tAPT is calculated based on the amount of tAPT and APT held by the contract.

There are quite a few ways you can use tAPT to earn an additional gain:

- Deposit tAPT in the Argo stablecoin protocol as collateral to mint USDA;

- Provide liquidity in tAPT pools on Liquidswap and other Aptos DEX platforms;

- Use tAPT in Aries Markets to borrow crypto and perform leveraged swaps.

Of course, you can also redeem tAPT for APT at any moment.

You can access Tortuga directly from the dApp directory in Pontem Wallet.

We only included mainnet dApps in this guide, which is why we didn’t feature Stader liquid staking Econia Labs, or Tsunami Finance, for example. However, new Aptos DeFi dApps go live on mainnet every month, so stay tuned for updates. Follow Pontem Network on Twitter, Discord, and Telegram, so you don’t miss the next ecosystem AMA or partnership announcement!

.svg)