PEPE and MEV Bots: Breaking Down a Memecoin Rally

In April 2023, PEPE started a new “memecoin season” when its price grew by 4,400x and the market cap reached $1.6 billion. Elon Musk even tweeted a picture of Pepe the Frog. The flipside was a spike in Ethereum gas fees caused by the activity of MEV sandwich bots that make millions trading memecoins.

TL;DR

- Memecoins are still hot - and Pontem has even hosted a memecoin-building workshop at the Aptos Hack Holland event in Amsterdam. Pontem co-founders shared some serious alpha on how to create a memecoin like $PEPE with Move on Aptos.

- PEPE is a memecoin on Ethereum, launched in April 2023 by anonymous developers. It’s not to be confused with another PEPE, a BRC-20 memecoin on Bitcoin that uses the Ordinals technology.

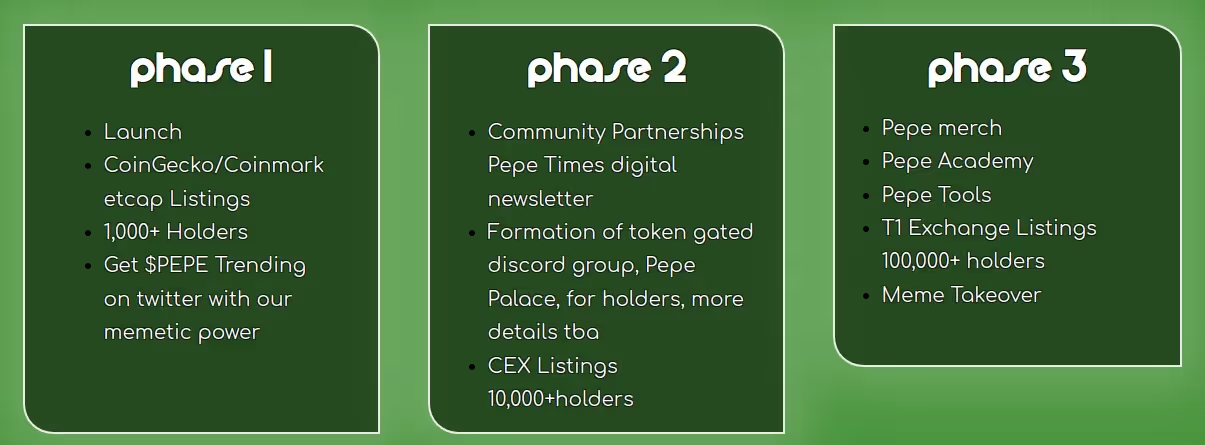

- PEPE is presented as “the coin for the people” and “the most memeable memecoin in existence.” The official website stresses that it has no utility and no formal roadmap.

- The total supply is 420 trillion, of which 93.1% was deposited in Uniswap liquidity pools. The creators burned the LP tokens and renounced the contract for transparency (i.e. they can’t issue more PEPE or manipulate the token in other ways).

- PEPE’s movement has so far followed the classic memecoin pattern: a period of accumulation (around a week), then a meteoric rise leading to major CEX listings, and a sharp sell-off with several lower highs.

- The price rose 4,400x in 3 weeks, then fell 70% after the listing on Binance on May 5.

- PEPE started a new memecoin boom, with tokens like WOJAK, LADYS, MONG, etc. also rallying.

- The main adverse effect for regular users was a sharp rise in Ethereum transaction fees, from $2 to $27 at the peak. It was driven by MEV sandwich bots in Uniswap liquidity pools.

- MEV stands for Maximal Extractable Value and covers strategies for extracting crypto profits beyond simple trading and investing, such as DEX front-running,loan liquidations, and NFT mints. MEV activities rely on bots.

- Sandwich attacks are a popular DEX MEV strategy, where a bot inserts transactions before and after a transaction submitted by another user to benefit from the price change. By setting a higher gas fee, the bot makes sure that its transaction is executed first.

- A single MEV bot known as jaredfromsubway.eth made over $7 million trading PEPE and other memecoins.

- In the second half of may, we saw another wave of memecoin hype, led by the NFT collector ben.eth and his memecoins $BEN, $PSYOPS, and $LOYAL. The presale of $PSYOPS was particularly controversial, because ben.eth asked buyers to send ETH directly to his wallet, promising to send $PSYOPS in return.

- Crypto influencer Pauly0x parodied ben.eth’s initiative, asking people to send ETH to his wallet yougetnothing.eth - and promising absolutely nothing. The address received over $1.3 million in ETH.

Latest news: Pontem-hosted memecoin workshop at Hack Holland

Before we delve into the 2023 memecoin rally led by PEPE, let’s talk about the Pontem-sponsored memecoin-building session at Hack Holland on June 5. This huge event, organized by Aptos Foundation, brought together the best teams building on Aptos, and Pontem sponsored one of the main tracks: Infrastructure, Tooling, Public Goods & AI.

As part of the event, Pontem hosted an exciting workshop on how to create a memecoin on Aptos, led by our co-founders and coding gurus Stas Oskin and Boris Povod.

Sure, Aptos already has some popular memecoins, such as Dog Laika Coin (DLC) and Aptos Doge (APTOGE). But as a blockchain ecosystem grows, it’s normal for new memecoins to pop up. So how do you create one using Move?

At the workshop, CTO Boris Povod shared some serious alpha on memecoin-building, including coding, security, tokenomics, design, etc.:

- The structure of a memecoin contract: name, symbol, supply, type, registration

- How to launch and run a safe mint

- How to add initial liquidity on Liquidswap and protect the pool from bots (and why it’s important to add liquidity during the mint itself and not after);

- The tools for coding and listing a memecoin: Pontem-created repository on GitHub, Intellij PyCharm, Move IDE plugin, Move Code Playground by Pontem, Liquidswap

Understanding the Pepe meme

Pepe is a true crypto icon. The green frog appears in hundreds of crypto memes – happy, crying, saying GM to lay-to-Earnhis “frens”, etc. But the character itself is older than Bitcoin and even has controversial political associations.

Pepe the Frog was created by the artist Matt Furie in 2005, with the tagline “Feels good man”. A few years later, users on Reddit and the imageboard site 4chan started posting their own Pepe memes.

By 2015, the image became popular among the alt-right – a mostly online far-right political movement in the US. Donald Trump once even tweeted an image of himself as Pepe. Many of the Pepe memes created in this period featured nationalist and conspiracy theorist themes.

In crypto, though, Pepe became the symbol of the community spirit and affection for one’s “frens”, without right-wing associations. The first-ever NFTs are even called Rare Pepes. Pepe is often mixed with the image of a bull to show hope that market bulls will ultimately defeat the bears.

About Pepe Coin

PEPE was created by anonymous developers as “the most memeable memecoin in existence,” “a coin for the people,'' and “a symbol of love, unity, positivity, and freedom”.

The token has a humongous supply of 420 trillion, 93.1% of which were deposited in the initial liquidity pool on Uniswap. The creators then burned the LP tokens for that pool and renounced the ownership of the contract.

The remaining 6.9% of the supply is kept in a multisig wallet to finance CEX listings and other project development activities.

The official website states that PEPE is “completely useless” and has “no intrinsic value”.

Don’t confuse PEPE on Ethereum with PEPE, the BRC-20 token on Bitcoin, which we covered in our detailed article on BRC-20. Both are memecoins, both rallied hard, and neither has utility, but they are completely different tokens on different blockchains.

PEPE has now been listed on Binance, KuCoin, Gemini, Huobi, Coinbase, ByBit, OKex, Crypto.com, and many other exchanges.

By the way, did you know that there are memecoins on Aptos, too? A couple are even whitelisted in Pontem Wallet and on Liquidswap: APTOGE (Aptos Doge) and DLC (Dog Laika Coin).

The memecoin timeline

April 14: PEPE is deployed on Ethereum.

April 15: PEPE is first listed on Uniswap in a pair with WETH. The starting price is around $0.000000001. A group of potentially connected wallets immediately buy almost 10% of the supply.

May 5: PEPE is listed on Binance. The price rises by 90% in 24 hours to reach 0.0000044, 4,400x the initial Uniswap price. PEPE’s market cap peaks at $1.67 billion.

May 6: The price falls over 40% from the May 5 peak.

May 8: The price falls down 60% from the peak. Ben.eth announces $BEN.

May 11: A Twitter user shares a screenshot of a Coinbase newsletter where Pepe the Frog meme is called “an alt-right hate symbol”. In response, #deletecoinbase starts trending on Twitter, with some users announcing they would close their Coinbase accounts. The next day, Coinbase apologizes.

Top traders and investors sell a net $3 million of PEPE in 24 hours, according to Nansen.

May 12: As Bitcoin drops below $26,000, the price of PEPE goes under 0.000001 and the market cap falls to $440 million, down over 70% from the peak. Ben.eth announces $PSYOPS.

May 13: Elon Musk tweets a Pepe picture. The price is up 80% from the lows as #PEPEARMY and #pepeislove start trending on Twitter.

May 30. Pauly0x asks users to send ETH to yougetnothing.eth; raises almost $1.4 villion in 5 days.

The structure of a memecoin craze

The whale accumulation stage

To understand how typical memecoin mania spreads, let’s look at this chart by the popular trader and technical analysis expert @Anbessa100.

Note that the first 10 days on the chart have pumps and sell-offs that look small in comparison with the main rally, but those are still 30-50% swings. However, the ultimate winners are those who buy early, soon after the first DEX pools open, and hold until the real pump. Some of these are whales, or large buyers. Often, they are insiders, perhaps even the devs themselves.

Are there reasons to think that PEPE has its own insider whales? Yes. Analysis by @apes_prologue reveals that 13 wallets were created and topped up with ETH just to buy PEPE several minutes after the listing on Uniswap. Together, these wallets controlled almost 10% of the supply.

Interestingly, even after PEPE rose 1000x, the wallets didn’t sell. At this point, they held over $9 million in PEPE. But if they were to sell even part of their holdings, the price would have collapsed: there wasn’t enough liquidity on Uniswap to absorb such a large sale. Only a CEX listing would provide enough liquidity to tolerate a dump.

The bubble stage and the blow-off top

Next comes the bubble phase as users start feeling the FOMO (fear of missing out). This stage can be short and relentless, with people jumping in on every small dip. During this period, the rally can still be driven by the organic memetic power of the community. Everyone is waiting for a big CEX listing, thinking that it will start “the real pump”.

The reality is usually the opposite: after listing on a large CEX like Binance, most tokens go through sharp sell-offs as early buyers take profits.

On May 8, Lookonchain tweeted an updated list of the top 15 PEPE holders. Most of the addresses in it differed from the earlier @Louround list, but altogether they still held 9% of the supply and were sitting on millions of dollars in unrealized gains.

Selling so many tokens can be a problem. You need exit liquidity – users who will buy all those tokens off you at a reasonably high price.

For a whale, it can make sense to use paid marketing to attract exit liquidity. One of the methods is to collaborate with influencers. On this chart from @IncomeSharks, you can see how tweets by notorious influencers like MoonCarl and Crypto Rover appeared around the blow-off top.

Another tool is viral hashtags: you can pay for an army of Twitter bots to post tweets with catchy hashtags to make them appear in the Trending section.

Trending memecoins on Twitter: DYOR before you get the FOMO!

If you’re considering buying a memecoin that is trending on Twitter, it’s very useful to check if those are organic mentions or bot shills, and match the hashtag pattern against the price chart.

Anyone, be they whales wishing to sell, developers, or rabid fans, can engage in these tactics on Twitter.

In PEPE’s case, we saw trending hashtags like #PEPEARMY, #pepeislove, and #MemeCoinSeason trend as it approached all-time highs. For example, on May 13, #PEPEARMY was still trending after the token rallied 80% from the lows following a massive sell-off. Searching for the latest mentions of the hashtag revealed clear bot activity, with the same “users” posting several identical replies every minute with the same hashtags.

If you check the profile of such an account, you’ll usually see lots of retweeting, often of the hashtag in question, ) but no original tweets. Bot replies can also be more sophisticated, with messages like “PEPE will be bigger than Bitcoin” or “PEPE is the next 100x”. Bot marketing often becomes even more aggressive as the memecoin craze enters the copycat stage, with new memecoins appearing every day and a lot of competition among them. Dubious airdrops and scams also spread. Be careful, use your judgment, and remember: if something seems too good to be true, it probably is.

MEV bots

Even if you don’t trade memecoins, you’ve probably felt one of the PEPE craze: rising Ethereum gas fees. Charts paint a dramatic picture: from $2 in December 2022 to $27 at the peak six months later (though it did go down to $12 by mid-May).

It’s not because thousands of people were suddenly trading PEPE and WOJAK, though. The real culprits are MEV sandwich bots: algorithms that exploit swaps submitted to the queue by regular users. Together with early whale investors, bot operators are the real winners of memecoin season.

Bots bid higher gas fees to outrace each other. They spend millions of dollars on gas, but they also make millions in profits for their creators. Meanwhile, everyone else loses money on expensive gas. Let’s explore this sinister side of the PEPE craze in detail.

What is MEV and who are searchers?

MEV stands for “maximal extractable value.” The term can apply to any strategy in crypto that allows you to extract a profit beyond simple investment or trading profits. Front-running, arbitrage, liquidations on lending platforms, and NFT mints are areas where MEV strategies are often used.

Originally MEV meant “miner extractable value”, but wiith the rise of Proof-of-Stake blockchains that don’t have miners, MEV came to mean “maximal extractable value.” Searchers on Ethereum now work through intermediaries called block builders and relays, and the extra value is shared between searchers, intermediaries, and validators. Validators’ extra income also trickles down to their stakers.

The highest-ever MEV block reward received by an Ethereum validator was 689 ETH ($1.28 million) on April 10, 2023.

Some MEV strategies can be good for the market: for example, arbitrage helps to equalize token prices across DEXs. But others, like sandwich attacks, hurt regular users. And, as we’ll see with PEPE, many MEV bots cause losses to DEX users by pushing up gas fees and increasing slippage.

MEV sandwich attacks on Uniswap and other DEX

A sandwich attack means inserting one’s own transaction before (front-running) and after (back-running) a transaction submitted by someone else to profit from the result of their trade. We published a deep-dive article on this topic when Pontem launched front-running protection on Liquidswap, but here’s the gist:

Sandwich attacks are possible because all the queued transactions sit in the blockchain mempool before processing, and anyone can view them. A special MEV bot scans the mempool and calculates the impact that every trade will have on the price.

Let’s say that there’s a big buy in the queue, submitted by Bob, and that this buy will increase the price by 3%. The bot then sends its own buy transaction with a gas price higher than Bob’s. That way, Ethereum validators will execute it first, even though it arrived in the queue later.

The bot also submits a sell transaction for the same amount, but with the gas price that’s just a tiny bit lower than Bob’s. Then this happens:

1) The bot’s buy order is processed, making a small positive price impact (depending on the size and liquidity in the pool);

2) Bob’s buy order is processed, with a bigger positive price impact – and at a worse price than Bob expected (because the bot’s purchase had already pushed the price up a bit);

3) The bot’s sell order is processed, with a profit for the bot.

Many MEV bots can inhabit a popular liquidity pool, where they try to outbid each other with higher gas fees. Over 90% of their revenue goes to validators, which is known as “bribes.” Because of this, the profit margin of a MEV bot can be pretty low.

However, a bot only engages when it sees a clear opportunity to make a profit; for example, it won’t target small transactions that make very little price impact, or huge pools where the effect of a single transaction is generally low.

For a human DEX user, there are three negative effects:

1) Higher gas fees. When there’s a lot of MEV bot activity, the average gas fee rises. That’s what we’ve seen with PEPE.

2) Higher slippage. Slippage is a difference between the initially calculated swap price and the actual price. Slippage results from other transactions that are processed between the moment you submit your swap and the moment it’s executed.

3) Failed swaps. You can lower maximum slippage in the swap settings, but there is a risk that the swap will fail and you’ll lose the gas fee.

Read our article on front-running to learn how to protect yourself from sandwich bots

How the biggest PEPE MEV bot earned $1 million in a day

Meet jaredfromsubway.eth. (The name comes from the Subway sandwich chain spokesperson, who is actually a convicted sex offender serving a prison term.) They spent $1.1 million on Ethereum gas fees in 24 hours and still made a nice profitwith a very successful MEV sandwich bot. (Hence why he’s named after Subway.)

The sandwich bot went live on February 21, 2023, but gained notoriety in April, when it became the single biggest gas spender on the Ethereum network, mostly trading PEPE and other memecoins.

On April 18 and 19, the MEV bot made over $2 million in profit from 24,000+ sandwich attacks – with $100 million in PEPE trading volume a day! Jared’s other favorite memecoins are WOJAK, APED, CHAD, MONG, LADYS, and BOB.

That week, 60% of all Ethereum blocks featured transactions initiated by jaredfromsubway.eth. Their 30-day profits (April 13 – May 13) reached $7.26 million according to EigenPhi, the leading MEV analytics platform.

Jaredfromsubway.eth topss the leaderboard of MEV sandwich bots on Ethereum, with over $7 million in profit in a month. (The second biggest made $387,000.)

A few things give Jared from Subway an edge:

1) Paying higher bribes to validators. According to the creator of another bot, Yannick, the norm is 97% of the revenue, but Jared gives away up to 99.9%.

2) Holding a lot of memecoins. An average MEV bot holds ETH, uses it to buy a memecoin (the front-run part of the sandwich), then sells the memecoin for ETH (the back-run part). jaredfromsubway.eth does the opposite, selling memes coins like PEPE for ETH, then re-buying PEPE lower at the end. Holding memecoins is riskier, but it pays off, because they can construct attacks that other bots can’t.

3) Catching new memecoins early. Sometimes Jared buys a new token minutes after it is listed on Uniswap, while the price is still extremely low.

4) Stuffing several swaps on different token pairs into the same transaction to save time and gas money.

At the same time, the bot has been spending a fortune in gas fees: $33.2 million in 30 days as of May 13. As of May 12, MEV bots were the third biggest gas spenders on Ethereum after the entirety of Uniswap and wrapped ETH, according to Nansen.ai.

Ben.eth, $PSYOPS, and yougetnothing.eth: the second wave of the memecoin craze

After the price of $PEPE plummeted, many thought that the rally was over. But in mid-May, we were treated to another, even weirder wave of memecoin hype. It was orchestrated by one man: an NFT collector known as Ben.eth.

You have probably heard of the crypto influencer Ben Armstrong, better known as BitBoy Crypto. He is (probably) not the same person as Ben.eth, but when the latter issued a memecoin called $BEN, BitBoy endorsed it and announced that he was joining the $BEN team.

Soon, Armstrong revealed that he was completely taking over the $BEN project, and that ben.eth would become an advisor. A day later, on May 12, ben.eth revealed his second memecoin: $PSYOPS.

By the way, on May 17 it became known that BitBoy had sold all of his $BEN, in spite of an earlier commitment not to do so. However, by that time the attention had shifted to $PSYOPS.

What made the $PSYOPS launch so controversial is that users were told to send ETH directly to ben.eth’s wallet. It was the opposite of a trustless presale - just like in the good old ICO days. There wasn’t even a contract yet: buyers were simply told that they would receive their $PSYOPS.

In 3 days, ben.eth collected a staggering $7 million in ETH, but the contract went live only on May 18, several days later than promised. Worse, many users reported receiving tiny amounts of $PSYOPS after sending large sums in ETH. Observers also noticed that while the $PSYOPS pool on Uniswap V3 did hold $25M in liquidity, less than 2% was ETH, and the rest was $PSYOPS.

By late May, many pre-sale investors were down 90% on their holdings. Ben.eth conducted a second airdrop, but even after it $PSYOPS buyers were still down 50%. A law firm even threatened Ben.eth with a class action suit.

This didn’t stop Ben.eth, though. On May 30, he announced his third memecoin, $LOYAL, in collaboration with BitBoy. This time, the token was supposed to have utility as the native asset of a new DEX, PsyDEX. $LOYAL, $BEN, and $PSYOPS holders would all get benefits, such as a share in the DEX’s revenue.

Nobody knows if PsyDEX will actually launch. Meanwhile, Ben.eth didn’t waste time and released an NFT collection called FF6000 (the RGB color code for orange). All 10,000 identical orange squares were minted out in 15 minutes for 0.1 ETH each, earning Ben.eth another 1,000 ETH.

FF6000 NFTs are supposed to give holders “early access to some future products” (though it’s not known which), together with an orange badge for Twitter. As of early June, they were trading around 0.2 ETH on OpenSea, so at least the original minters can recoup their money.

The curious case of Pauly’s Yougetnothing.eth

Ben.eth’s $PSYOPS “presale” sparked a mini-trend, with people asking Twitter users to send ETH directly to their addresses for one purpose or another. The most audacious was crypto influencer Pauly0x, who suggested that users send ETH to his new address yougetnothing.eth - on the premise that they would get absolutely nothing in return.

In a few days, yougetnothing.eth accumulated $1.4 million in ETH and generated a whole wave of “nothing” memes.

Pauly0x didn’t create a memecoin or an NFT collection, but he used the meme power of crypto. That’s what memecoins are ultimately based on: not utility, but the mysterious community energy that makes crypto so different from any other market.

We may still see another memecoin rally in 2023, and even new highs for PEPE. Who knows?

But remember: meme tokens have no utility, even when they get listed on a major CEX. They are purely speculative. And while we do not give financial advice, we can remind you of this basic rule: never invest any money that you’re not prepared to lose.

About Pontem

Pontem Network is a product studio building foundational dApps for Aptos. Our products include:

- Pontem Wallet -- the best Aptos wallet

- Liquidswap -- the first DEX (AMM) for Aptos

- Move Playground -- a simple browser Move code editor

- Move IntelliJ IDE plugin for developers

- ByteBabel -- a Solidity-to-Move translator, and the first EVM for Aptos

.svg)